Capital Executive LLC

Intel Corporation (INTC)

_edited.jpg)

Investment Thesis

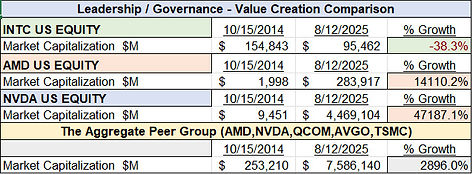

Even though, INTC has been a pioneer in Silicon Valley. However, for the last twenty years, INTC has aimlessly attacked the market and destroyed significant shareholder (ownership) value.

To maximize the market value of the organization,

-

INTC should merge with AMD because the long-term competitive threat comes from the ARM chip architecture - not AMD.

-

The combined businesses must be legally split into a Design business and a Manufacturing (foundry) business.

-

Design should be led by Dr. Lisa Su - CEO AMD

-

Manufacturing should be led by the most talented, seasoned, engineering executive currently at TSMC, possessing a vision kind of like Dr. Morris Chang coming out of Texas Instruments (TI) after ~25 years. Apparently, before Dr. Chang left TI, he pitched a bold new business model (the "pure play" foundry) to the leadership of TI - unsuccessfully!

-

Afterwards, the Taiwanese government invited Dr. Chang to visit the island and help the nation develop its tech industry.

-

The rest is history, because Dr. Chang not only founded TSMC but also built TSMC into the most advanced manufacturer of micro processing chips in the world .

-